Quads + Unemployment: When Our Financial Security Collapsed

The Storm Before The Storm

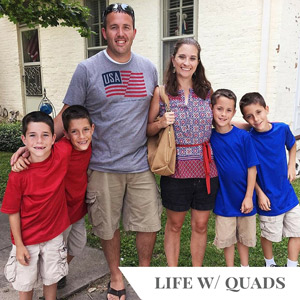

When we found out we were expecting quadruplets in August of 2006 we thought their care would be the biggest financial hardship we would ever face as a couple. The estimated hospital bills for my high-risk care, as well as extended intensive care for four preemie babies, were quoted to us in the millions, not thousands. That didn’t even start to account for their diapers, formula, clothing, etc. It was difficult to fathom how we would financially survive.

God was so faithful to us during that first year. Friends and family supported and loved us well. Diapers appeared from strangers. Our insurance covered more than we estimated.

Our two income family merged overnight into a single income when I went on unpaid medical leave at 13 weeks. We lived extremely frugally, and were thankful for advice that we had taken from Dave Ramsey’s radio program prior to that life-changing birth day. We had socked away savings, paid off our car loan, and then paid off our remaining school loans shortly after their birth to leave more room in our monthly income for baby expenses. We also had equity in our home, due to rehabbing a repo during our first few years of marriage. We had no idea, how important those financial decisions would play out in our lives. Our savings took a significant blow, but we were still standing.

Surely we had survived the worst of it.

The Big One

Not quite. The last day of September 2009, proved that assumption false, when Brad learned that his job had been cut. With four 2 1/2 year olds to provide for, and no other income to fall back on, those days proved to be some of the scariest. Our security blanket of having a guaranteed paycheck was ripped out from underneath us. What in the world was God doing?

We had no idea how to navigate this road.

It was such an emotional blow, as well as a financial one. We had no one to bail us out. We had no Plan B. And in hindsight, I wish we would have sought counsel with someone who could help us walk through those difficult weeks that turned into months.

But we did the only thing we knew how to do. We held on.

Survival Mode 101

We held on to each other. We held onto the promise that God would work this for our good – for His good. We walked through it together, day by uncertain day.

When our emergency fund started to dwindle, some days were faced with confidence that God would be faithful to provide for us. Other days we fell apart with disappointment, frustration, and lots of unanswered questions along with the grueling job search in a depressed economy.

Would we loose our home? Would our kids have what they needed? What would we do for insurance for our family? Would we have to humble ourselves and ask for help from family and friends?

These are the questions that on rare occasion we were brave enough to ask out loud. Most of the time, they were the unspoken words that hung like a cloud trying to consume us.

You know why I think we couldn’t speak them? Because we were too afraid of the answers. The what-if’s were too dangerous. The stakes were too high.

If Hindsight Is 20/20

I wouldn’t change much about those difficult days, even as rough and shaky as they were. Trials build character, faith, and perseverance – but I wish we would have met with someone who could have walked us through a financial plan during those months. Someone locally who could have helped us answer those tough questions, and helped calm our worst-case scenario fears. If someone could have professionally taken a look at our situation with our 401K, retirement, and monthly expenses, we could have developed a tangible plan of action for the months ahead. Instead we gritted our teeth and blindly walked through it on our own.

If you know someone in your life that is facing financial difficulty, or if you just need to talk to someone about investing, college savings, retirement, or where to start, I would highly recommend finding an ELP {Endorsed Local Provider} through Dave Ramsey. It’s so rare these days to find someone reliable, competent, and trustworthy, and the ELP service provides all of those and more. Dave’s team has already vetted these professionals to make sure they will give you sound and trusted advice. As Dave is always saying, “they will give you the advice your grandmother would have given you, only they’ll keep their teeth in“.

{Thanks so much to Dave Ramsey’s Endorsed Local Providers for sponsoring this blog post and allowing us to share our personal financial story.}

Thanks for sharing this, Jen! We definitely need to begin working with a financial planner. After getting ourselves into debt and more debt, we’ve slowly worked out way out {mostly} – but there’s still so much work left for us to do. And, honestly, we don’t know where to start or how to make it happen (much less how to force ourselves to stick to a budget!!). Your and Brad’s story is so inspiring – showing so clearly how God provides – but also motivating. Thank you!

We’re still digging out four years later. Lessons learned and lessons still to be learned. Just thankful for grace and second chances through it all. Planning and recovering is such a big part of it all, and I think we could have saved a lot of worry and sleepless nights by just having someone walk us through and hear us out.

Oh hindsight- such a dollar short/day late teacher! I love the idea of this program- trusted advisors that have been vetted would take some of my skepticism out of the equation, that’s for sure (commission! they’re just talking to us for the commission!).

Me too! It’s so rare to find someone trustworthy + competent these days!

I appreciate your honest assessment of adventures in unemployment. We were right along side you around the same time. Our adventure lasted 3 years. We have always followed a Dave Ramsey financial model, so we never had to dip into savings but we went bare bones survival mode the whole time – nothing extra, not even paper plates. But we made it. And in spite of the discomfort, a lot of good came out of it, not the least of which is the sobering knowledge that it could happen again on any given day. I still think twice and three times before I toss anything in the shopping cart. Thanks for sharing your story.

That is such a sobering reality that breeds both gratitude and being vigilant to budget for the unexpected. We are still working our way out of the strain our finances have faced the last few years, but we are so thankful that we didn’t make any life-altering mistakes in the process.

Thanks for sharing your story and experience as well!

I have been SO stressed out lately because of the cost of this move. I had no idea moving overseas would be so expensive! I can’t wait to live under a budget again! Good thing Europe is so cheap…..oh wait….drats! 🙂

Jen: Just reading your story makes me scared! God is good to always provide—even when it seems scary. I agree–having someone walk you thru financial helps would be awesome!

a