New Year’$ Resolutions: Making Goals That Make Cents

Can you believe 2014 is just countdown hours away? A new year is upon us, and it’s a perfect time to reflect on 2013 and make goals for 2014.

We often make fitness goals, personal goals, even spiritual goals, but often neglect looking at the thing that keeps the world going around. MONEY. What financial goals did you reach this past year? What are some ways you can improve for the next year? What are some practical steps you can take each month to achieve these goals? These are great conversations to have now before you ring in the New Year.

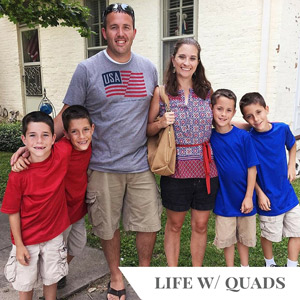

Brad and I have been having some good evaluating conversations about things we would like to financially change for 2014, and things we did well in 2013.

Here are some things on our list that we would like to improve financially this coming year:

~ Stick to budgeting and the accountability that comes from knowing where each dollar goes. {We’ve gotten lax in this area the past few years.}

~ Get our tax documents in early this year to our tax professional

~ Change to a cash envelope system for much of our spending – groceries, clothing, and other expenses

~ Have a better grasp of our retirement accounts by seeking professional investing advice

~ Plan for health insurance changes to come in 2015

~ Refund our emergency fund from past “emergencies” that have hit

Things financially we did well in 2013 that we need to continue:

~ Monday night bill night. {So romantic.}

~ Understanding our health insurance plans and current options

~ Saving back each paycheck for self-employment taxes

~ Practicing intentional spending over impulse or want-based shopping

How about YOU? Have you planned financially for 2014? Have you set specific goals that are attainable? Are you prepared for the fiscal year ahead?

{Thanks so much to Dave Ramsey’s Endorsed Local Providers for sponsoring this blog post and allowing us to share our personal financial story.}

Thanks for this! Hubby and I desperately want to sell our home and move in 2014. Since we’re underwater in our mortgage (thanks, 2009!!), it’s going to take a lot of discipline for us to recoup our losses and have $$ for a down payment. I need to be much more intentional in my spending. I’m already seeing a difference in myself though–only went to 1 Target, one time for Christmas clearance vs my usual easily 10+ trips in this week between the holidays.

We need to move to cash & monitor everyday spending better. If we can Couple that will better planning for vacation & “special events”, and we’d be in good shape! One thing we did well this year was utilize our HSA account, and negotiate repayment terms with medical billing to match when our contributions were made, so the money came out of that account directly & we didn’t have to reimburse ourselves.