Financial Goals for 2011 Part 2: Surviving. Spending. Saving.

Part of moving forward financially, is looking back at things you could have done better. I shared with you last week some of the ways we saved in 2010 and some strategies on how we’ve been able to cut costs, but there’s definitely ways we can improve in 2011.

Splurge Only On Things That Matter.

I’ve never regretted a splurge that has benefited our marriage. Our weekend getaway in the Fall? Worth every hard earned penny. Going to a modest dining establishment on a date over fast food? Justified now and then. Paying a very reasonable fee for a church workout facility during the crazy winter months? Certainly. Investing in your health is valuable.

Regrets: An extra Christmas gift for the boys that was selfishly more about me than them. Buying a bargain just because it was a really great deal.

Be Accountable.

Adjusting to the work at home salary schedule has made it tough to budget. A job that gets completed may take 3 months or more to pay out, future work is hard to predict, expenses fluctuate, etc. However, we still need to be accountable for what we are spending each month, even if we don’t meet our budget. Although we sat down together and went through our expenses and account balance we weren’t disciplined enough in tracking our spending.

Regrets: Not forming a written budget and creating monthly itemized spending limits Not meeting often enough with my husband to go over goals and concerns. Not planning ahead for the next month.

Don’t Waste Money On Things You Can Get for Free (or almost free)

Until I started couponing more consistently, following deal sites, and organizing my shopping trips by combining deals, I didn’t realize how many items that I was buying on a weekly basis that I could practically eliminate from our grocery budget. Since then I have drastically cut our grocery budget spending on items such as cereal, toothpaste, deodorant, razors, laundry detergent, and yogurt. You really can get things for free or nearly free by a combining a manufacturer’s coupon with a special sale price at your local grocery and drug stores. Don’t worry I’m not an “extreme couponer” by any means. I only get what we need, and I only stockpile a few items if we will need them before the sale repeats itself. (I can share more if this is something that interests you!)

Regrets: Why didn’t I start this earlier? Why did I think it sounded too good to be true? Why didn’t I take the time to learn the strategies?

Learning to Trust God Over And Over Again

I thought I learned this lesson during our uncertain and often dark days in my high-risk pregnancy. God has shown me through this trial that I rely too often on my own strength. I’ve wasted energy worrying, trying to plan for financial expenses, and attempting to work things out on my own. Oh for grace to trust Him more!

Regrets: Not depending on God fully and trusting Him as our ultimate Provider.

What are some financial lessons you have learned along your journey?

If you missed Part I of Surviving Spending Saving, feel free to go back and take a read!

Jen, I am so appreciating your candor in all of this. The ‘selfish’ Christmas gift, especially. I am so there with Lola’s first birthday right now–wanting to do so much and get her all this ‘stuff’, and she won’t even remember this day! 🙂

I am couponing as well, and saving mounds on drugstore items since I’ve started. It has helped our budget tremendously! Thanks for this series….I look forward to reading more.

You go girl. We give only 3 gifts to our girls at Christmas – a book, a toy (usually nice and bigger), and clothing. It’s more of a boundary for me than for them. Because I can coupon and clearance my way to lots of stuff. 🙂 But in the end stuff is still stuff even if it’s FREE stuff. And if you’re not careful stuff can own you.

I’m writing a series on 31 Days to Reduce Your Debt right now and it has been extremely cathartic and centering. We’re probably a year away from being Debt Free (I cannot believe it since we started in April of 08 and have paid off over $80K). Budgets, coupons, and frugal living seemed so restrictive before we took the plunge and now SO liberating.

Hope to get to chat at Blissdom. 🙂

I keep my budget in an excel file. It has income at the top and expenses at the bottom. I have it formulated to automatically carry my totals over. I set mine up for 2 times a month since that is when I get paid, but it can be broken down to weekly or done monthly. I can adjust things as income/expenses change. If I budget $200 for electric and it comes in higher – I just change it on the spreadsheet and it adjusts the totals all the way around.

The best part is I can see my whole year at a glance. I can see where I will be next year if I stick to my budget and I can see where I have a little room to wiggle.

If you are interested in trying it – email me and I will send you a clean copy. It has been the best thing I have ever used. It really keeps me on track.

I would love a copy of this. I had one on my old puter. But it crashed and I’ve lost it. Thank you in advance

Alicia Williams

alishort15@yahoo.com

No problem. I will send it to you when I get home this afternoon.

KS Dallas, I would love a copy of this also. We are building a house and I need to get myself on a budget.

Thanks,

Kathleen

kathleenmires@hotmail.com

I appreciate your honesty about all of this, Jen. We’re down in income this year as well and looking at how we can cut back. I have to say I’m jealous of the coupon opportunities in the States – in Canada there’s no combining deals or crazy super sales like you guys have. 😉 It’s really frustrating seeing so many frugal blogs giving advice that just isn’t possible here! I feel like I spend too much on groceries but just don’t see how we could cut back much more.

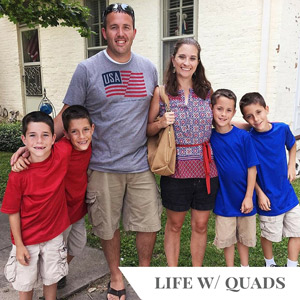

Great topic Jen. John and I recently started using cash only for groceries. We (OK, I ) was spending WAY over our budget on groceries – definitely our biggest monthly fixed expense. My husband gets paid twice monthly so we decided to split the monthly grocery budget in two. Now, every 2 weeks, I take 1/2 of our monthly grocery budget out of the ATM machine and I keep it in an envelope used solely for the purchase of grocery items. I’m already finding it a MUCH better way to shop rather than just pulling out my ATM card. I’m much more aware of how much I’m spending and am finding I’m making smarter choices when shopping. I’m also couponing and following ads more. Every little bit helps! Getting my quads out of diapers will be a HUGE help! We’re working on it 🙂

Jen,

Please share you couponing tips, and ideas. I 4 mouths to feed also. Not quads, just 2 sets of twins 🙂 I am very interested in getting more organized for the new year and would love to hear how you do it with the coupons and how often the sales repeat themselves.

Glad to share what I know! I’ll keep sharing! =) Thanks, Kathleen!